Good news | Shanghai Huarui Bank's "Bank-government Cooperation Model" won the industry honor, enabl

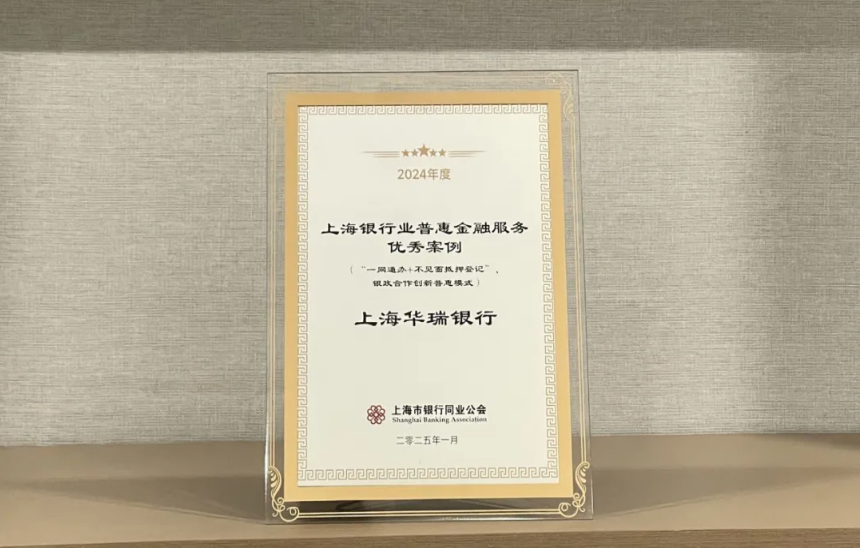

Recently, in the "2024 Excellent Work Achievements Selection Tree Promotion Activity" organized by Shanghai Interbank Association, Shanghai Huarui Bank stood out by virtue of the "One-Netcom Office + non-meeting mortgage registration" bank-government cooperation innovation inclusive model, and was successfully awarded the "Excellent Case of inclusive financial Services in Shanghai Banking Industry". This honor is not only a high recognition of Huarui Bank's innovative practice in the field of inclusive finance, but also a strong witness of its active implementation of the mission of a financial power.

For a long time, small and micro enterprises face many difficulties in mortgage registration financing. Cumbersome procedures make business owners travel back and forth between the bank and the real estate registration center, which consumes a lot of time and energy, and the long waiting period also seriously affects the efficiency of financing, resulting in poor service experience. Shanghai Huarui Bank keenly caught this pain point, actively responded to the call of Shanghai to promote the registration of real estate mortgage "full network office", gave full play to the advantages of digital financial services and local geographical advantages, and joined hands with relevant departments to open up the "last mile" of "mortgage financing" services.

Under this innovative model, the "online inclusive business loan" product of Shanghai Huarui Bank has achieved a major breakthrough. When customers apply for operational mortgage loans, with the help of data sharing applications, they can directly apply for mortgage registration online on the "OneNetcom Office" platform. The use of digital technologies such as identity authentication, online double recording, and electronic contracts allows customers to easily complete all mortgage procedures through mobile phone face recognition. The application materials are fully electronic, and are pushed to the real estate registration system platform in real time, and the banks and real estate registration agencies cooperate online in auditing and handling, truly realizing the leap from "at most one run" to "one run without running", and effectively "let the data run more and let the masses run less".

In December 2024, the first customer verification of "non-meeting mortgage registration" passed, and the "first" licensed mortgage registration (to the bank) "full network office" business in Shanghai successfully landed. At the same time, Huarui Bank's online inclusive business loan products support customers to apply for loans by themselves with the help of WeChat mini programs, and provide whole-line consulting and guidance services through AI digital people.

This award is a milestone for Shanghai Huarui Bank in the field of inclusive finance. In the future, Huarui Bank will continue to uphold the spirit of innovation, deepen inclusive financial services, continuously improve service quality and efficiency, inject a steady stream of financial vitality for small and micro enterprises and regional economic development, help Shanghai create a better business environment, and make more contributions to the journey of building a financial power.